Cons of Decentralized Trading

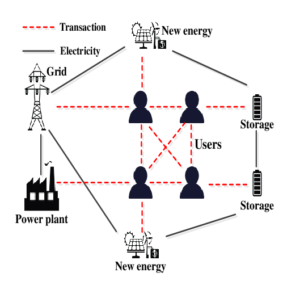

In the case of decentralized trading, each trade is conducted through a decentralized exchange. The system does not store any user funds or personal data. Instead, it simply provides a platform for matching bids and offers. In a decentralized exchange, trading takes place peer-to-peer. Some popular examples of this type of trading are UniSwap, MDEX(BSC) and BurgerSwap. Together, these exchanges have a daily trading volume of over $4 billion and a market share of over 50%.

One of the biggest disadvantages of using centralized exchanges is the fact that new projects are not reviewed by the exchange, which means that they may not be vetted. On the other hand, decentralized exchanges don’t have this problem. Any new project will most likely list on a DEX before its rivals. Another advantage of decentralized exchanges is that they can publish scams, which centralized exchanges have difficulty doing. A recent example is the rug pull, a classic exit fraud.

In comparison to centralized exchanges, DEXs do not store users’ private keys. They are therefore vulnerable to hackers, and some traders prefer to manage their private keys themselves. A major disadvantage of DEXs is that the security of transactions is not guaranteed, since there are no third parties involved. Some traders, however, prefer to maintain control of their private keys. Furthermore, Decentralized trading exchanges rely on smart contracts to make sure that transactions are processed properly.

Although there are some drawbacks to decentralized exchanges, there are many advantages. It has the potential to be more transparent, offer advanced trading tools and increase volume. The only real drawback is that it’s more difficult to match market makers. Nonetheless, it has seen some growth and has been gaining volume. So, if you’re looking for an alternative to traditional exchanges, decentralized trading might be for you.

The Pros and Cons of Decentralized Trading

While decentralized trading has its pros and cons, it does have its drawbacks. While centralized exchanges have many advantages, decentralized exchanges have fewer risks. For example, centralized exchanges may be less secure than decentralized exchanges. But the downsides are often worth considering. And that’s a good thing. There are also a few open issues to be resolved. If you’re a big trader, you can use a DEX as a middleman.

The main disadvantage of centralized exchanges is the fact that they take title to your assets. By contrast, with decentralized exchanges, you can keep title to your assets, without paying for the services of the exchange. This is a major drawback, but it’s a necessary one. By definition, the two systems are different, but they share the same underlying technology. In addition, the differences are subtle. The main disadvantages are related to security and user privacy.

A decentralized exchange gives a person or institution more control over his or her assets. Because it is decentralized, there are no restrictions on the amount of money you can invest or withdraw. A decentralized exchange also gives you more flexibility, as you don’t have to deal with third parties. If you choose a centralized exchange, you’ll get access to many more options than you could with a non-decentralized exchange.